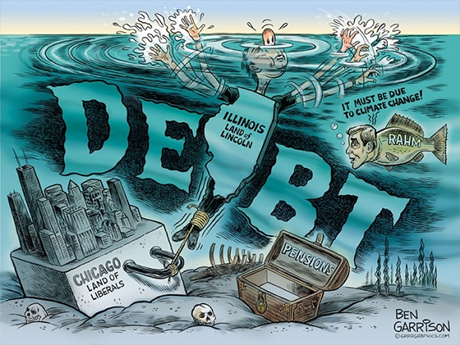

The blue state of Illinois, Land of Lincoln – and of course, Barack Obama – has become the tragic victim of its own fiscal irresponsibility. Somehow promising billions for government employees’ pensions seemed like a good idea at the time. Unfortunately, someone forgot to plant the magical money trees. And now, oops – as the Daily Signal reports:

Over the past three decades, Illinois’ pension liabilities increased 755 percent while its population edged up only 13 percent […]

That has caused taxpayers to take a hit and government services—like Illinois’ education system—to suffer.

Here kids, do the math (the results aren’t pretty) ~

Recently, 89 cents of every new dollar of education spending has gone not to the classrooms but toward teachers’ retirement costs. By 2025, the state will spend more on retired teachers than it does on those who are actively teaching, as well as all other classroom costs.

Now of course the real solution to this dilemma – as all good big government bureaucrats know – is…. more taxes! ~

The Chicago Fed – that’s the Chicago branch of the Federal Reserve System – has proposed an idea for dealing with a part of Illinois’ pension problem. Since the problem is that many state and local government pension funds were criminally-underfunded for decades (on purpose, since Illinois politicians believe you can always just raise taxes later), the Chicago Fed has proposed a trial balloon: a thirty-year special assessment of an additional 1% of home values. Only for thirty years or so.

Don’t worry that this proposal would only address the five pension funds administered by the state. The other 650 or so government pensions across Illinois, [like in the town of Harvey, IL which has already increased property taxes and laid off 1/2 of their firefighters] and all of Illinois’ many other problems, would remain unaddressed by this proposal… but at least those five state pension funds would finally be made whole. In thirty years. They hope. 🙄

Illinois residents already pay the highest property taxes in the country. This new proposal is simply untenable ~

Picture a typical Illinois home worth $300,000, receiving a $9000 annual property tax bill. This homeowner is already paying 3% in property taxes (though in some areas the average is four, five, or more percent already). Yet another one percent would add another $3000 to the homeowner’s bill each year… for thirty years, the duration of a typical starter homeowner’s 30-year mortgage obligation.

Naturally, decades of imprudent planning and reckless spend and tax antics like this are driving beleaguered taxpayers to more fiscally-responsible states ~ People are exiting “blue” states and the reason isn’t the weather ~

For four years in a row, Illinois has lost population in alarming numbers. In 2017, Illinois lost a net 33,703 residents, the largest numerical population decline of any state. That’s the size of St. Charles or Woodridge or Galesburg. Wiped off the map. In one year […]

Asked why they were leaving people overwhelming said taxes or the Illinois budget mess.

“We could handle the cold, avoid the crime and pay the tax. But the government turned on us (property, income, sales, parking, red-light/speed cameras, bags, soda). Never-ending. Tired of paying for everyone else’s retirement before mine,” said one respondent.

John F. Di Leo at Illinois Review correctly predicts what this proposal means for the spendthrift Prairie State ~

The proposal’s alleged benefits are built on a foundation of sand, because the pension obligation of today will only grow, but the population of Illinois taxpayers in years to come will only shrink […]

We are driving away the taxpayers we need, through ever-higher taxes. And when higher taxes are your problem, higher taxes cannot simultaneously be a solution.

Dear liberals, there are no magical money trees. Reality always wins in the end.

~~~~~~~~~~~~~

Related:

This Illinois Town’s Story Shows the Fate Others Will Face in Pension Crisis ~ Frankly, it’s not just Illinois, the numbers are really staggering on a country-wide basis ~

A report from the American Legislative Exchange Council estimates that state and local pension funds have promised $6 trillion more in benefits than they have set aside to pay. That is $18,676 for every man, woman, and child in America, or nearly $50,000 per household.

Did the income tax make Illinois solvent, as promised? Did the lottery fund Illinois education, as promised? Did the tollbooths go away once the expressways were built, as promised? Have any promises ever made by an Illinois politician ever been kept?

Blue states take note — residency may crater as state taxes rise ~ How the impact of the 2017 Tax Cuts and Jobs Act may further exacerbate the Blue State flight

Illinois Liberals Destroy Home Values to Fund Union Pensions ~ Rush Limbaugh explains just how onerous this would tax plan really is ~

(The Federal Reserve Bank of Chicago says:) “New taxes wouldn’t affect people thinking of moving to Illinois. While they would have to pay higher property taxes, that would be offset by not having to pay as much for their new homes. In addition, current homeowners would not be able to avoid the new tax by selling their homes and moving because home prices should reflect the new tax burden quickly.”

In other words, they fully expect the value of you in Chicago and Illinois who own your homes, the value of those homes to plummet with the application of these new property taxes. So people arriving in the state are gonna be able to afford your house because you’re gonna have to practically give it away, which means you’re gonna lose every bit of equity and wealth you have in your house if you try to sell it and leave.